The Truth about the Honey Trade in the Caribbean

The first truth that must be accepted is that Caribbean islands have been importing “natural honey” from the United States of America since, at least, 2018. The United States Department of Agriculture (USDA) publishes their production data, alongside import and export data on honey products publicly online. These reports, referred to as the National Honey Reports1, contain all the information on North American production, alongside quantities and countries of importation and exportation, as well as the types of products that are traded. The content of these reports provides evidence of the extent of honey trade in the Caribbean.

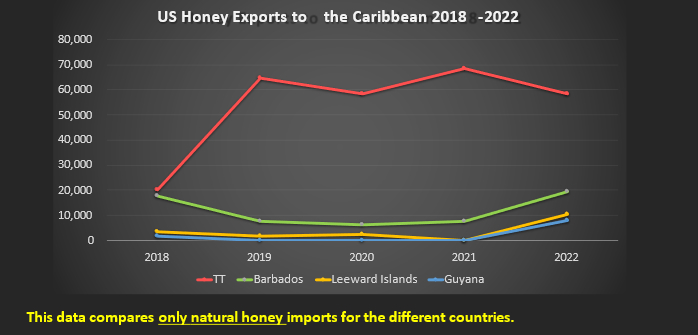

The Caribbean country with the highest natural honey imports, according to the USDA records, is Trinidad and Tobago (Figure 1) which interestingly, has a legislative ban on importing honey. Barbados, Guyana, and Leeward Islands also have imported natural honey but in smaller quantities.

According to the statistics (Figure 1), the quantities of natural honey being imported by all these countries has increased from 2018-2023. Between 2020–2022, Trinidad and Tobago’s natural honey imports ranged between 58,000-68,000kg, whilst Barbados’s natural honey imports ranged between 6,000–19,000kg (Figure 1).

Figure 1-US National Honey Exports to Caribbean Island 2018 – 2022. These values were taken from the USDA reports for 2018 – 2023, and only include data under the heading “Natural honey, not elsewhere indicated or specified”.1

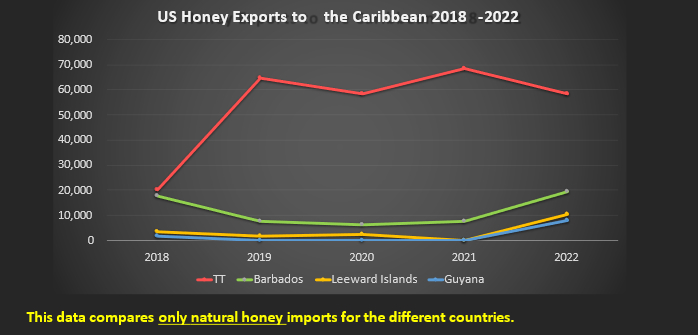

The more interesting statistics however are the results and data for the importation of “comb and natural honey packaged for retail sale” (USDA 2018-2023, Figure 2). These results indicate that in 2022, Barbados imported 133,000kg of comb and natural honey for retail, which is almost twice the amount of Trinidad and Tobago.

Figure 2 USA Total Honey Exports to the Caribbean2

The importation of honey is dependent on the ability of Caribbean countries to meet local and regional demands, which varies across countries and regions within the Caribbean. In some cases, local honey production may be able to meet the domestic demand, such as Jamaica, Cuba, or the Dominican Republic, where local production may be sufficient to meet domestic demand. These countries have a strong tradition of beekeeping and a higher level of self-sufficiency in honey supply. In other countries, such as Trinidad and Tobago2, Guyana3, Antigua & Barbuda4 and Barbados5, there may be a gap between supply and demand, leading to the need for honey imports.

Imported honey can now be found dominating the local, retail markets in St. Kitts & Nevis, Antigua & Barbuda and Dominica (Figure 3, 4 and 5).

Figure 3 – Leading supermarket chain in St. Kitts & Nevis containing multiple brands of international honey brands.

Figure 4 – Leading supermarket chain in Antigua & Barbuda containing multiple brands of international honey brands.

Figure 5 – Leading supermarket chain in Dominica containing multiple brands of international brands on display.

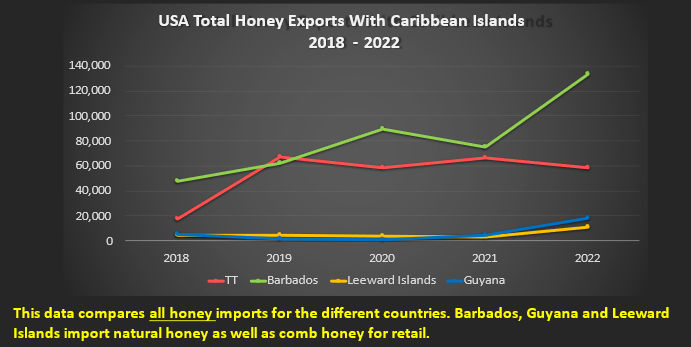

The CARICOM Guidelines for intra-regional trade of Honey recommends that honey should be pasteurized or irradiated in order to be traded. Many of the OECS islands, are dominated by international honey brands which do not meet these requirements. Many are advertised as raw honey, some going as far as to claim their product is wholesome and unpasteurized (Figure 6). Some brands boast a US Grade “A” standard but are actually blends of honey from around the world (Brazil, China, India, Argentina, Uruguay), and are clearly marked on the label (Figure 7).

Figure 6 – Imported honey from the US labelled as non-pasteurized.

Figure 7 – Imported honey from the US labelled as Grade A but consisting of honey from USA, Canada, Argentina, and India.

The statistics provided above account for legitimate trade of honey from the USA. There are, however, no statistics on the illegal trade of honey, which is occurring within the Caribbean. There are however newspaper articles that speak to the illegal trade: recent newspaper articles in Trinidad and Tobago6,7 indicate that Trinidad and Tobago Customs seized 60 five-gallon buckets or 1,632kg of honey, the value of which was estimated to be $250,000TTD, entering the country illegally by boat from Venezuela. These products can then be bottled and sold legitimately, using labelling that meets the requirement for the specific country.

The truth about the honey trade is that there is already a strong honey trade amongst Caribbean islands and more importantly, with countries outside the region. ACBO acknowledges that, based on the data provided, and evidence on the ground of foreign honey products in most Caribbean countries, that the free trade of honey in the Caribbean is already reality.

For most of the Caribbean countries, which do not have legislative bans on honey trade, there are opportunities for developing new regulations and laws to support the trade of honey. However, for countries like Trinidad and Tobago, the importation of honey contravenes the Beekeeping and Bee Products Act of 1935. Local beekeepers continue to reinforce their position that they do not wish to have imported honey, which leaves the country in a quandary since this position also contravenes the CARICOM Chaguaramas Treaty. Regional beekeepers are calling on their government to develop and implement strong protocols which will safeguard their bees from diseases, and which will not include pasteurization and irradiation, as outlined in the CARICOM guidelines for intra-regional trade.

There is clearly a quagmire facing regional regulators, especially those in Trinidad and Tobago since there is no way to reverse the current trade of honey. The only recourse that Caribbean beekeepers have is to advocate for proper regulations for the importation of honey.

The beekeeping sector in most Caribbean countries has received little investment since the early 1900’s and as a result remains severely underdeveloped2,3,4,5,8,9. How do we bring apiculture in the region into the 21st Century and increase production to meet the needs of the Caribbean households without marginalizing the independent indigenous apiculturist? One suggestion is to invest the money, which is being used to import honey; that it be invested into the local beekeeping sector. Along with a realistic honey trade framework, consisting of proper regulations and testing, also needs to be put in place, with representatives from the sector at the discussion table at a local and CARICOM level.

The ACBO offers its services to Caricom and its member state Governments in developing a strategy for addressing the trade of honey, which is inclusive of all stakeholders, especially beekeepers. The organization has a wealth of apiculture expertise at its disposal, in the areas of biodiversity, environmental management, project management, apiculture practice, etc. Its members stand poised to work with other key stakeholders in the sector to address this in a holistic manner, which is inclusive of local beekeepers and safeguards pollinators.

In closing the Apiculture Sector needs to legally align itself with the Chaguaramas Treaty but must not do so at the detriment of livelihoods and the precious ecosystem we all enjoy.

1 United States Department of Agriculture. 2018-2023. National Honey Report. Agricultural Marketing Service Specialty Crops Program Market News Division. Unit 1, Produce Row Room 101, St. Louis, MO 63102. https://usda.library.cornell.edu/concern/publications/m613mx60p?locale=es#release-items

2 Central Statistical Office, Agriculture Statistics Division, Quantity of Apiculture Products sold by Type of Product and Method of Disposal. The data was collected using semi-annual apiculture survey during period H1: January to June H2: July to December. Last Updated: 1st November, 2021. https://cso.gov.tt/wp-content/uploads/2021/11/Quantity-of-Apiculture-Products-sold-by-Type-of-Product-and-Method-of-Disposal.xlsx

3 Kaiteur News. 2017. Demand for honey exceeds local production – GCCI official. November 07, 2017. https://www.kaieteurnewsonline.com/2017/11/07/demand-for-honey-exceeds-local-production-gcci-official/

4 Smith, N. 2006. Antigua hit by Vampire Mite. https://issuu.com/beesfd/docs/80_bfdj_sep2006/s/14181256

5 Harman, A. 2018. Catch The Buzz – Barbados Want To Ramp Up Honey Production And Begin Exporting Instead Of Importing. The Magazine of American Beekeeping. https://www.beeculture.com/catch-buzz-barbados-want-ramp-honey-production-begin-exporting-instead-importing/

6 Sambrano, C. Customs seize $250,000 in illegal honey. May 16th 2023. Trinidad Guardian. https://www.guardian.co.tt/news/customs-seize-250000-in-illegal-honey-6.2.1677953.6b22b14e67

7 Loutoo, J. 2023. Customs seize $250,000 in illegal honey. Trinidad and Tobago Newsday. https://newsday.co.tt/2023/04/10/customs-seize-250000-in-illegal-honey/

8 Matthias, R. A. 2022. Apiculture: A Catalyst For Sustainable Development In Small Island Developing States (SIDS). Baseline Survey of Management Practices In The Apiculture Industry In Dominica, Grenada, Saint Kitts & Nevis, Saint Lucia, Saint Vincent & The Grenadines, Samoa & Trinidad And Tobago. Statistical analysis by Sharda Mahabir PhD. Published as part of the South-South Regional Project funded by GEF SGP, Castries, St. Lucia. https://gefsgpundpsaintlucia.org/download/baseline-study-on-management-practices-in-apiculture/

9 Budhu, S. and R. Permanand 2014. The Development of the Honey Industry in Trinidad and Tobago. The Ministry of Planning and Sustainable Development, The Economic Development Board Port of Spain. https://www.acboonline.com/wp-content/uploads/2016/06/EDC-The-development-of-the-honey-sector-in-Trinidad-and-Tobago.pdf